Unlocking India’s Tech potential with Navi Nifty IT Index Fund NFO

Unlocking the Power of India’s Tech Titans: Navi Nifty IT Index Fund Direct Growth

In the fast-paced world of investing, opportunities abound, but few sectors shine as brightly as India’s booming technology industry. For those seeking to harness the potential of this dynamic sector, the Navi Nifty IT Index Fund emerges as a beacon of opportunity. Designed to replicate the performance of the Nifty IT Index, this open-ended scheme offers investors a gateway to India’s top IT companies, including behemoths like Infosys, TCS, and Wipro. With a New Fund Offer (NFO) launched recently, now is the perfect time to delve into the details of this innovative investment vehicle.

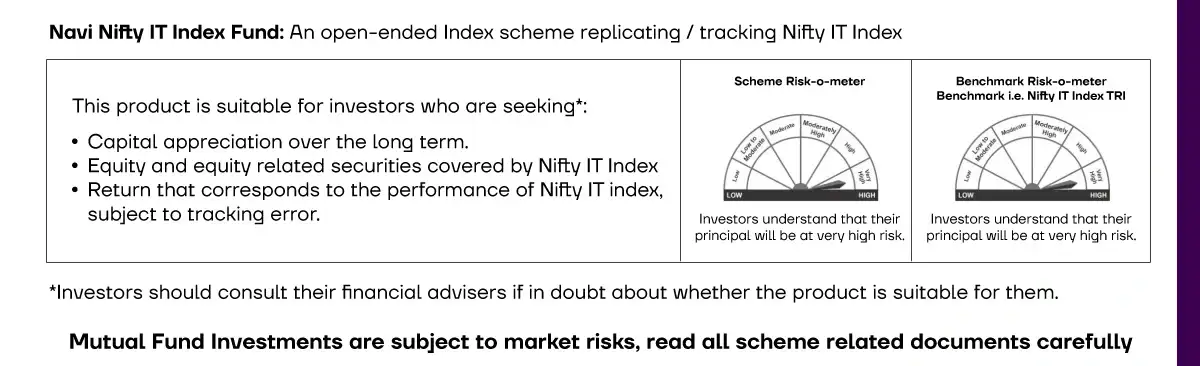

Navi Nifty IT Index Fund Direct Growth is an equity new fund offer (NFO) launched by Navi AMC Limited. The investors can apply to the NFO from 11 March 2024 to 22 March 2024. As per the SEBI defined riskometer, the Navi Nifty IT Index Fund Direct Growth is rated Very High Risk.

Investing in India’s Tech Leaders with Navi Nifty IT Index Fund:

The allure of India’s IT sector lies not just in its past successes, but in the promise of future growth and innovation. By investing in the fund, individuals gain exposure to a diversified portfolio of the country’s leading IT companies. With a basket that includes giants from the Nifty 500 index, investors can ride the wave of India’s tech revolution, backed by names synonymous with excellence in the industry.

Diversification for Stability:

One of the hallmarks of prudent investing is diversification, and this fund offers just that. By spreading investment risk across multiple well-established IT firms, the fund helps cushion against individual stock volatility. This diversification strategy enhances stability and mitigates the impact of adverse events on any single company, providing a smoother ride for investors in the turbulent waters of the stock market.

Accessibility and Affordability of the Fund:

Gone are the days when investing required substantial capital. With the Navi Nifty IT Index Fund Direct Growth, individuals can start their investment journey with as little as Rs. 10. This low entry barrier democratizes investing, making it accessible to a wide range of investors, regardless of their financial background. Furthermore, the fund boasts one of the lowest Total Expense Ratios (TER) in the industry, ensuring that investors retain a larger share of their returns.

Attractive Returns and Long-Term Growth:

The past performance of the Nifty IT Index speaks volumes about the potential returns awaiting investors. With an impressive annualized growth rate of 21.49% over the past five years, as of February 29th, 2024 (Source: Bloomberg), the index exemplifies the growth trajectory of India’s IT industry. By investing in this Fund, individuals position themselves to capture this growth over the long term, building wealth steadily and securely.

Risk Assessment and Suitability:

It’s crucial for investors to align their investment choices with their financial goals and risk tolerance. The Navi Nifty IT Index Fund caters to individuals seeking capital appreciation over the long term, with a focus on equity and equity-related securities covered by the Nifty IT Index. While past performance is no guarantee of future results, the fund offers a compelling opportunity for those bullish on India’s tech sector.

Invest wisely, invest in India’s tech titans with the Navi Nifty IT Index Fund Direct Growth:

In conclusion, the Navi Nifty IT Index Fund Direct Growth stands out as a premier investment option for those looking to tap into the potential of India’s burgeoning technology industry. With its diversified portfolio, accessibility, attractive returns, and low expenses, the fund presents a compelling case for investors seeking long-term growth and stability. As India continues to cement its position as a global IT powerhouse, investing in this could be the gateway to unlocking substantial wealth creation opportunities.

How to Invest in Navi Nifty IT Index Fund NFO: A Step-by-Step Guide

Investing in the Navi Nifty IT Index Fund’s New Fund Offer (NFO) presents a golden opportunity to tap into India’s thriving IT sector. In this guide, we’ll walk you through the process of investing in this promising fund, including convenient options like the IND Money App and the Navi App.

Step 1: Download the IND Money App or Navi App:

To kickstart your investment journey, download either the IND Money App or the Navi App from the Google Play Store or Apple App Store. Both apps provide user-friendly interfaces and comprehensive investment tools to help you navigate the world of mutual funds and free demat account effortlessly.

Step 2: Register and Complete KYC:

Upon downloading the app of your choice, register by providing necessary details such as your name, email address, and mobile number. Follow the prompts to complete your KYC (Know Your Customer) process by submitting relevant documents online. This step ensures compliance with regulatory requirements and enables you to start investing seamlessly.

Step 3: Navigate to Mutual Funds Section:

Once your KYC is verified, navigate to the mutual funds section within the app. Here, you’ll find a diverse range of mutual fund options, including the Navi Nifty IT Index Fund Direct Growth NFO.

Step 4: Explore Navi Nifty IT Index Fund NFO:

Within the mutual funds section, search for the Navi Nifty IT Index Fund Direct Growth NFO. You’ll find detailed information about the fund, including its investment objectives, strategy, and key features. Take your time to review these details to ensure alignment with your investment goals.

Step 5: Initiate Investment:

After familiarizing yourself with the NFO, proceed to initiate your investment. Specify the amount you wish to invest and choose the mode of investment, such as lump sum or SIP (Systematic Investment Plan). Confirm your investment details and proceed to make the payment.

Step 6: Monitor Your Investment:

Once your investment in the Navi Nifty IT Index Fund NFO is processed, you can monitor its performance conveniently through the app. Keep track of your investment’s progress, review periodic statements, and stay informed about any updates regarding the fund.

Investing in the Navi Nifty IT Index Fund NFO is a straightforward process that can be conveniently executed through the IND Money App or the Navi App. By following this step-by-step guide, you can seize the opportunity to participate in India’s thriving IT sector and potentially unlock substantial long-term returns. Get started today and embark on your journey towards financial prosperity with ease and confidence.

Disclaimer:

The information provided in this blog is for educational and informational purposes only and should not be construed as financial advice. Investing in mutual funds, including the Navi Nifty IT Index Fund Direct Growth NFO, involves inherent risks, and past performance is not indicative of future results.

Readers and investors are encouraged to conduct their own research and consult with a qualified financial advisor before making any investment decisions. The decision to invest should be based on individual financial goals, risk tolerance, and investment horizon.

The IND Money App and Navi App are third-party platforms that offer investment services, and their usage is subject to their respective terms and conditions. The mention of these apps in this blog does not constitute an endorsement or recommendation by the author.

Investors should carefully read the scheme-related documents, including the Scheme Information Document (SID), Key Information Memorandum (KIM), and Statement of Additional Information (SAI), before investing in the Navi Nifty IT Index Fund NFO.

The author and the platform hosting this blog are not liable for any losses or damages arising from the use of the information provided herein or from investment decisions made based on this information. Investments in mutual funds are subject to market risks, including the possible loss of principal amount invested.

Investors should be aware of the risks associated with investing in equity and equity-related securities, as well as the specific risks related to the IT sector. These risks may include market volatility, economic downturns, regulatory changes, and company-specific factors.

By reading this blog, you acknowledge and agree that the author and the platform hosting this content are not responsible for any investment outcomes or decisions made by readers or investors based on the information presented here. It is recommended to exercise caution and diligence when investing in financial markets.